Program Description

As maintenance and repair needs grow among Philadelphia’s aging rental housing stock, PHDC is committed to ensuring that small landlords can access capital to make much-needed repairs while maintaining reasonable rents. PHDC’s Rental Improvement Fund (RIF) offers loan products to small landlords to repair their rental properties. Loans are eligible for full forgiveness if landlords meet program affordability requirements during the loan term. If requirements are not met during the loan term, repayment with interest will be required.

Which landlords and properties are eligible?

- Landlords who own no more than 15 rental units across no more than 5 rental properties. This total includes rental properties owned by individuals and associated LLCs inside and outside of Philadelphia.

- Landlords must be able to produce a tax compliance certificate.

- Landlords must be current on all mortgages secured by the property.

- After RIF-funded repairs are completed, landlords must obtain and maintain an active rental license.

- Rental properties not already occupied by tenants must be occupied by tenants within one year of repair completion.

- Rental properties must be able to comply with the building code after RIF-funded repairs are complete, which means the cost of all essential repairs must fit within the RIF loan amount.

- For mixed-use and partially owner-occupied properties, RIF funds can only be used for repairs to the residential rental units and to building-wide systems. Funds may not be used for work in commercial or owner-occupied units.

- Units where the rent is affordable to households earning at or under 60% AMI (see rent guidelines chart below).

Maximum current rent for all units that will benefit from RIF repairs

| Maximum Monthly Rent by Number of Bedrooms | ||||||

|---|---|---|---|---|---|---|

| 0 (Studio) | 1 | 2 | 3 | 4 | 5 | 6 |

| $1,254 | $1,344 | $1,612 | $1,863 | $2,079 | $2,293 | $2,508 |

What repairs are eligible?

RIF cannot cover the cost of repairs completed before the loan is closed. All repair work must be done by a licensed and insured contractor. Loan proceeds can be used for any approved repair that addresses a safety, health, habitability, energy efficiency or water efficiency, concern. Examples of repairs that are covered include (but are not limited to):

- New and repaired roofs, windows, doors

- Repairs to deteriorated walls, floors and ceilings

- Asbestos, mold, and lead remediation

- Electrical and plumbing improvements

- Heating and cooling systems, and energy efficiency upgrades

Loan Products

RIF will lend a maximum of $100,000 to a single landlord.

Minor Repair Loan Product:

- Loan amount: $10,000-$24,999 per property

- Loan term: 10 years

- Forgiveness schedule: The loan will be forgiven 20% annually beginning in Year 6 if conditions are met.

- Interest Rate: 6% if affordability requirements are not met

| Minor Repair Loan Product | ||

|---|---|---|

| Maximum Estimated Repair Costs at Application | Contingency Included in Loan Amount | Maximum Loan Amount |

| $20,800 | $4,199 | $24,999 |

Moderate Repair Loan Product

- Loan amount: $25,000 – $100,000 – see table below

- Loan term: 15 years

- Forgiveness schedule: The loan will be forgiven 10% annually beginning in Year 6 if conditions are met

- Interest Rate: 6% if affordability requirements are not met

- Underwriting: The projected rental income must cover existing debt payments and other property-related costs (1.2 Debt Service Coverage Ratio)

- Repair requirements: The following repairs and upgrades may be required as part of the work scope for the moderate repair product:

- Weatherization

- Knob-and-tube remediation

- Roof repair or replacement

- Fuel oil or electric baseboard heater removal

- HVAC upgrade

- Electrification readiness measures

- Energy efficient appliance upgrades

| Moderate Repair Loan Product | |||

|---|---|---|---|

| Maximum Estimated Repair Costs at Application | Contingency Included in Loan Amount | Maximum Loan Amount |

|

| 1 unit properties | $42,000 | $8,000 | $50,000 |

| 2 unit properties | $42,000 | $8,000 | $50,000 |

| 3 unit properties | $63,000 | $12,000 | $75,000 |

| 4+ unit properties | $84,000 | $16,000 | $100,000 |

RIF will lend a maximum of $100,000 to a single landlord.

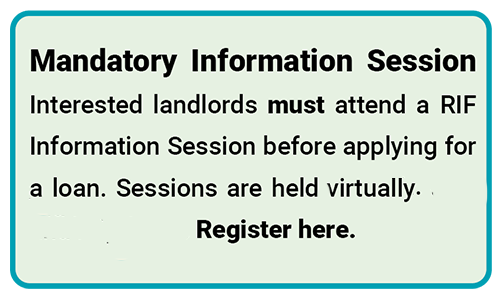

Application Process

Gather required application materials.

In addition to repair estimates and

current leases, you’ll need the

following RIF form:

![]()

![]()

Phone: 215-448-3006

Email: Rentalimprove@phila.gov